The #1 banking partner for high-performing fintechs

From lending to payments, control every aspect of your product without getting slowed down by infrastructure or compliance.

Account Balance

Account Balance

Why Coastal?

Modern banking infrastructure, built for innovation and scale

Only Coastal delivers the compliance, infrastructure, and APIs developers need to build products at speed. Move from sandbox to scale with enterprise-grade security and the freedom to integrate your way.

The Coastal Advantage

A strong partner makes all the difference. Coastal’s veteran team works alongside you from day one, bringing deep industry experience, hands-on guidance, and a track record of building high-performing financial products. We help you move quickly, avoid pitfalls, and get to market with clarity and confidence.

Move fast, stay compliant

AI-enabled, enterprise-grade infrastructure ensures your products meet federal and state regulations—streamlining compliance without slowing your team down.

Move fast, stay compliant

AI-enabled, enterprise-grade infrastructure ensures your products meet federal and state regulations—streamlining compliance without slowing your team down.

Move fast, stay compliant

AI-enabled, enterprise-grade infrastructure ensures your products meet federal and state regulations—streamlining compliance without slowing your team down.

Integrate seamlessly

Access developer tools and sandbox environments designed for smooth onboarding and fast, reliable integration.

Integrate seamlessly

Access developer tools and sandbox environments designed for smooth onboarding and fast, reliable integration.

Integrate seamlessly

Access developer tools and sandbox environments designed for smooth onboarding and fast, reliable integration.

Scale with ease

Resilient banking infrastructure that grows with you, supporting higher transaction volumes, complex programs, and evolving regulatory needs without re-architecture.

Scale with ease

Resilient banking infrastructure that grows with you, supporting higher transaction volumes, complex programs, and evolving regulatory needs without re-architecture.

Scale with ease

Resilient banking infrastructure that grows with you, supporting higher transaction volumes, complex programs, and evolving regulatory needs without re-architecture.

Accelerate Your Time to Market

Proven launch playbooks and embedded compliance let you bring products to market faster, reducing friction from ideation to scale.

Accelerate Your Time to Market

Proven launch playbooks and embedded compliance let you bring products to market faster, reducing friction from ideation to scale.

Accelerate Your Time to Market

Proven launch playbooks and embedded compliance let you bring products to market faster, reducing friction from ideation to scale.

Leverage proven expertise

Tap into a team that can help you navigate complexity, streamline decisions, and execute with precision.

Leverage proven expertise

Tap into a team that can help you navigate complexity, streamline decisions, and execute with precision.

Leverage proven expertise

Tap into a team that can help you navigate complexity, streamline decisions, and execute with precision.

Build and launch financial products with speed and control

At Coastal, we transform banking with innovative, embedded finance solutions.

Account Balance

Account Balance

$7,265

$7,265

Recent Transactions

Recent Transactions

Cards

Issue debit or credit products under your own brand with BIN-level control and instant scalability.

Cards

Issue debit or credit products under your own brand with BIN-level control and instant scalability.

Cards

Issue debit or credit products under your own brand with BIN-level control and instant scalability.

5022 3386 9820 1246

5022 3386 9820 1246

JOEY SURFMAN

JOEY SURFMAN

Payments

Move money instantly via ACH, wires, cards, FedNow, RTP, and more - right out of the box.

Payments

Move money instantly via ACH, wires, cards, FedNow, RTP, and more - right out of the box.

Payments

Move money instantly via ACH, wires, cards, FedNow, RTP, and more - right out of the box.

Invoice #6721

Invoice #6721

$54,998

$54,998

ACH Debit Transfer

ACH Debit Transfer

Invoice Received

Invoice Received

Invoice Approved

Invoice Approved

Deliver By

Deliver By

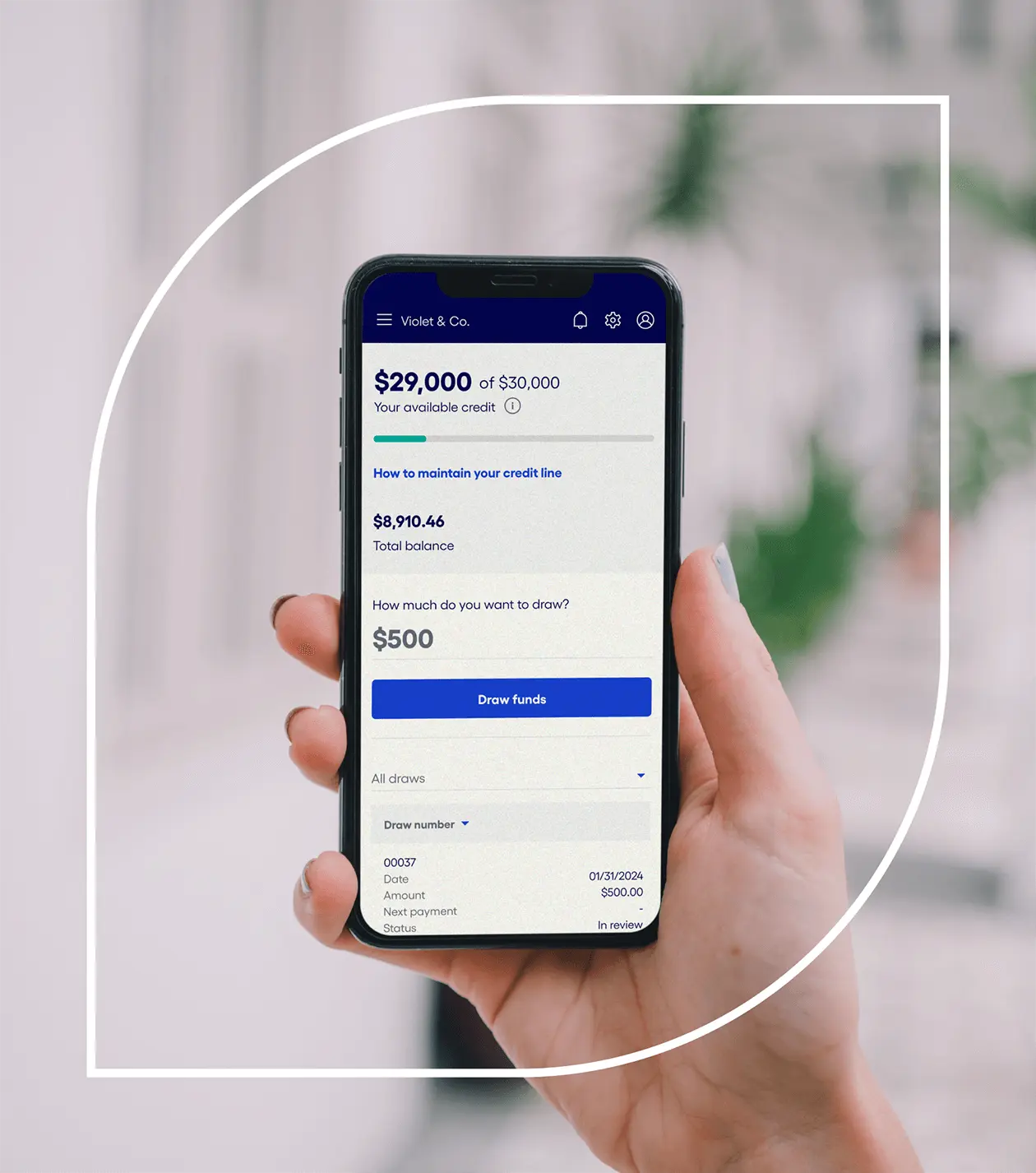

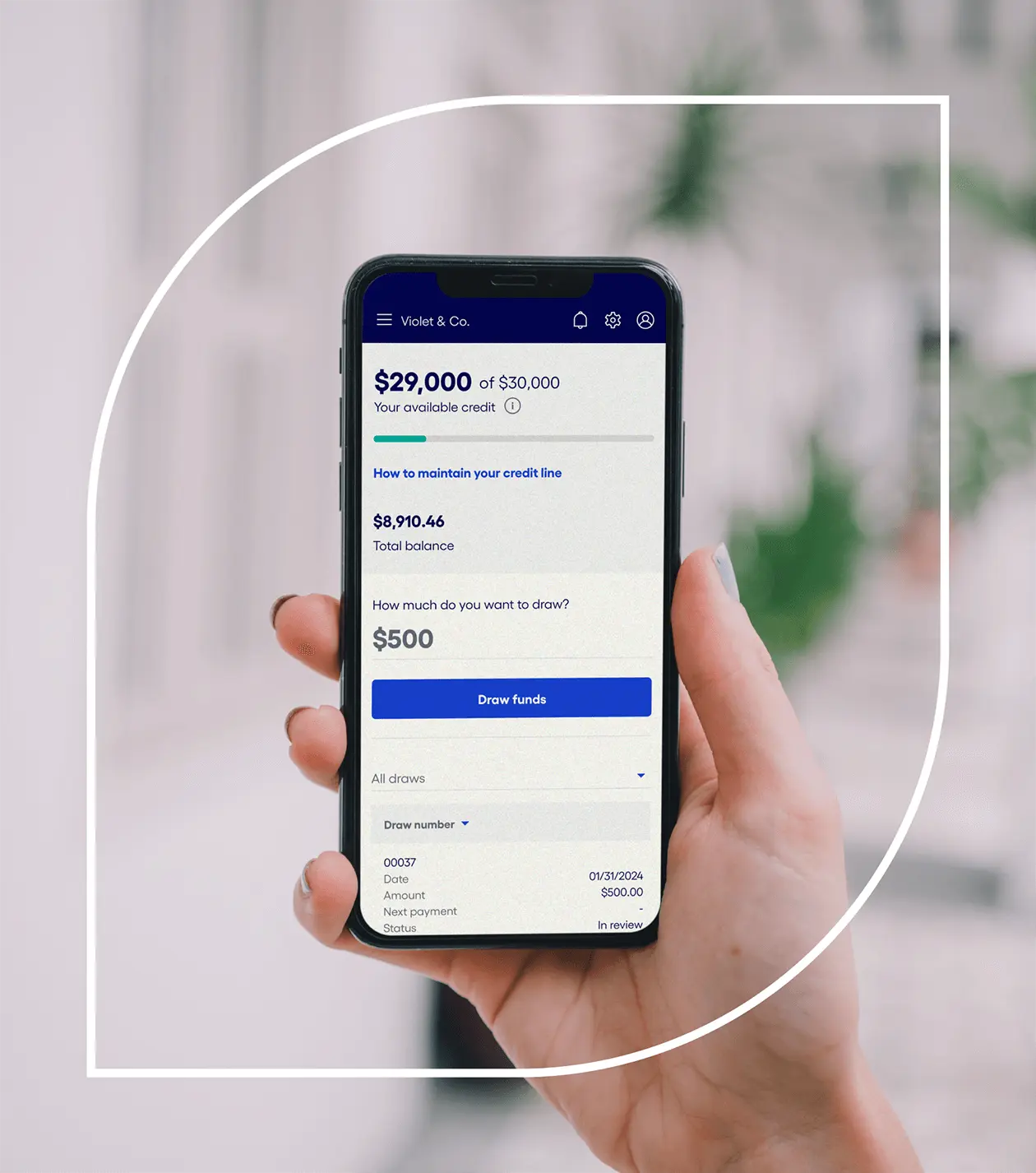

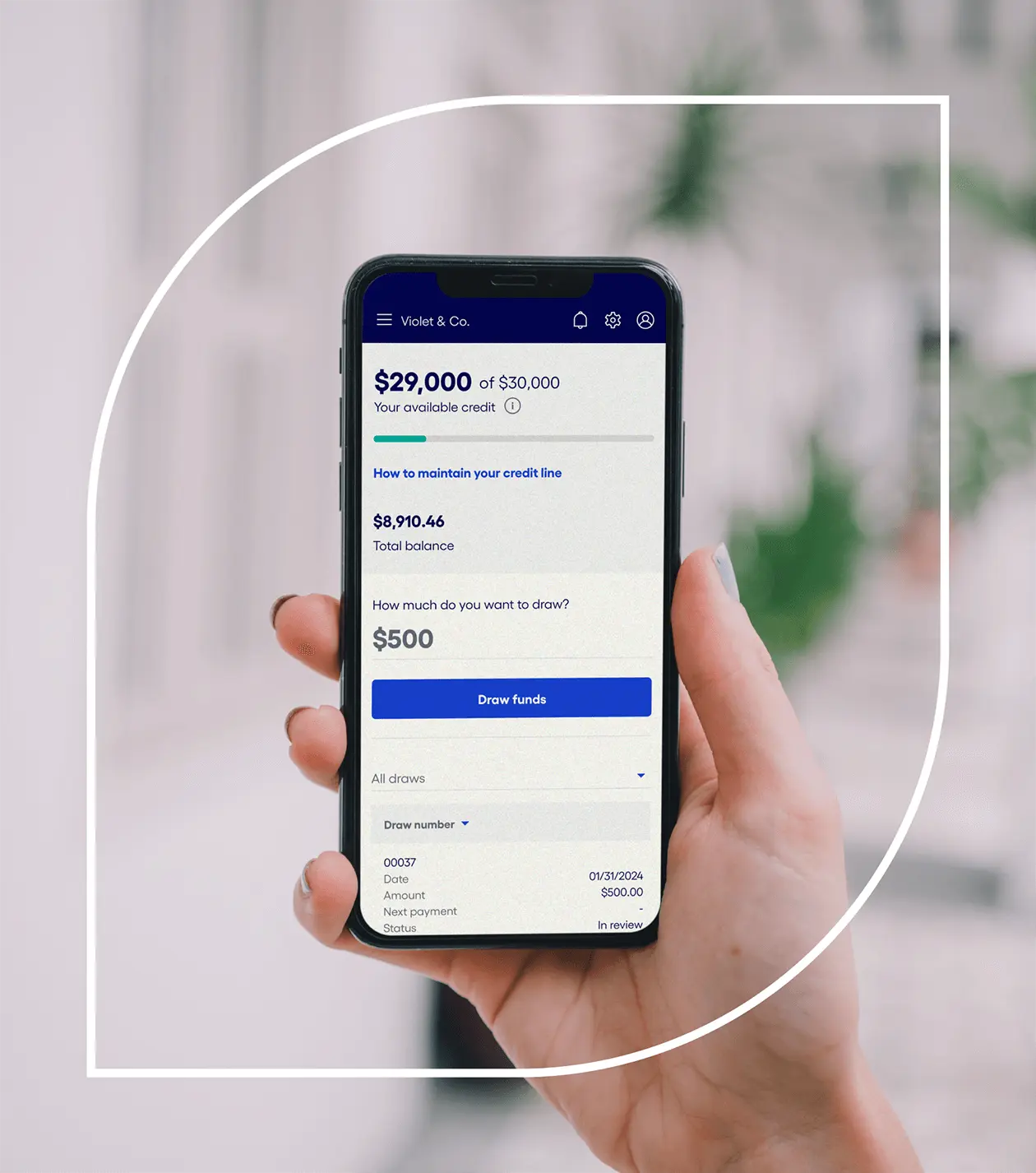

Credit & Lending

Streamline origination, financing, and loan purchasing in a single workflow

Credit & Lending

Streamline origination, financing, and loan purchasing in a single workflow

Credit & Lending

Streamline origination, financing, and loan purchasing in a single workflow

Loan Balance

$7,265

Fintech creativity with regulatory precision.

Coastal blends fintech innovation with banking expertise to deliver flexible, compliant solutions built around your product and customers.

$4.48 Billion

in assets

$3.93 Billion

in deposits

99.99%

platform uptime

Fintech creativity with regulatory precision.

Coastal blends fintech innovation with banking expertise to deliver flexible, compliant solutions built around your product and customers.

$4.48 Billion

in assets

$3.93 Billion

in deposits

99.99%

platform uptime

Fintech creativity with regulatory precision.

Coastal blends fintech innovation with banking expertise to deliver flexible, compliant solutions built around your product and customers.

$4.48 Billion

in assets

$3.93 Billion

in deposits

99.99%

platform uptime

“Executive collaboration with Coastal has been outstanding. The team is creative, solution-oriented, and genuinely thoughtful. They’re smart, hardworking, and truly a joy to work with day to day.”

Kate Handley, Director of Strategic Partnerships

“Executive collaboration with Coastal has been outstanding. The team is creative, solution-oriented, and genuinely thoughtful. They’re smart, hardworking, and truly a joy to work with day to day.”

Kate Handley, Director of Strategic Partnerships

“Executive collaboration with Coastal has been outstanding. The team is creative, solution-oriented, and genuinely thoughtful. They’re smart, hardworking, and truly a joy to work with day to day.”

Kate Handley, Director of Strategic Partnerships

"Coastal brings a level of quality and judgement that's rare. They balance big-picture strategy with practical execution, making collaboration effortless. Their partnership and responsiveness help us serve our customers with consistency and trust."

Sharon Carmeli, Chief Compliance Officer

"Coastal brings a level of quality and judgement that's rare. They balance big-picture strategy with practical execution, making collaboration effortless. Their partnership and responsiveness help us serve our customers with consistency and trust."

Sharon Carmeli, Chief Compliance Officer

"Coastal brings a level of quality and judgement that's rare. They balance big-picture strategy with practical execution, making collaboration effortless. Their partnership and responsiveness help us serve our customers with consistency and trust."

Sharon Carmeli, Chief Compliance Officer

Built for developers,

backed by bankers

Modern APIs with clear docs, backed by decades of banking and regulatory expertise—fintech speed with bank stability.

RESTful APIs

Intuitive, well-documented APIs that follow industry standards

Real-time Webhooks

Get instant notifications for all account activities and transactions

Comprehensive Docs

Detailed guides, API references, and example code to get you started quickly

Built for developers,

backed by bankers

Modern APIs with clear docs, backed by decades of banking and regulatory expertise—fintech speed with bank stability.

RESTful APIs

Intuitive, well-documented APIs that follow industry standards

Real-time Webhooks

Get instant notifications for all account activities and transactions

Comprehensive Docs

Detailed guides, API references, and example code to get you started quickly

Built for developers,

backed by bankers

Modern APIs with clear docs, backed by decades of banking and regulatory expertise—fintech speed with bank stability.

RESTful APIs

Intuitive, well-documented APIs that follow industry standards

Real-time Webhooks

Get instant notifications for all account activities and transactions

Comprehensive Docs

Detailed guides, API references, and example code to get you started quickly

Ready to launch your next financial product?

Your customers expect speed, reliability, and innovation—and your team deserves a platform that can deliver. With Coastal, you get enterprise-grade banking infrastructure that’s compliant, scalable, and developer-ready, so you can focus on building, launching, and growing products your users will love.

Ready to launch your next financial product?

Your customers expect speed, reliability, and innovation—and your team deserves a platform that can deliver. With Coastal, you get enterprise-grade banking infrastructure that’s compliant, scalable, and developer-ready, so you can focus on building, launching, and growing products your users will love.

Ready to launch your next financial product?

Your customers expect speed, reliability, and innovation—and your team deserves a platform that can deliver. With Coastal, you get enterprise-grade banking infrastructure that’s compliant, scalable, and developer-ready, so you can focus on building, launching, and growing products your users will love.

Modern banking infrastructure, built for scale and innovation.

Have a question?

commercial@coastalbank.com

Modern banking infrastructure, built for scale and innovation.

Have a question?

commercial@coastalbank.com

Modern banking infrastructure, built for scale and innovation.

Have a question?

commercial@coastalbank.com